It might be half-joking or self-deprecating but sayings like ‘lying flat’ or ‘investing in your CV’ touched lots of nerves in China for a while, not least due to news about the FDI deficit and slower GDP growth estimates.

How has the downturn affected different industries? To what extent would the recent policy moves aimed at boosting confidence and spurring foreign investment be effective?

Let’s take a closer look at four key sectors in China to see how they have performed in 2023, what 2024 may have in store for them, and potential opportunities for UK businesses, too.

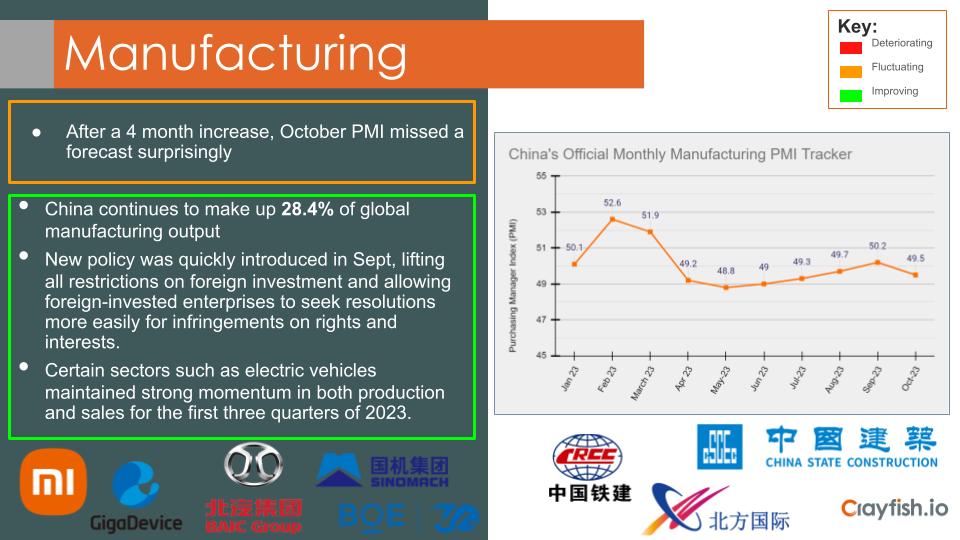

Manufacturing

- The manufacturing industry in China represents 28.4% of global manufacturing output. However, in 2023 manufacturing has been one of the quicker industries to recover with a gradual, stable growth period in Q2.

- To stimulate more stable growth, in September the government introduced a new policy lifting all restrictions on foreign investment in manufacturing companies.

- Surprisingly in October, China’s manufacturing PMI contracted and missed a forecast of 50.2. According to NBS, this was due to the timing of Golden Week which meant fewer working days in October and was not supported by foreign investment which has seen little uptake so far.

- This contraction demonstrates how fragile China’s economy continues to be.

- One exception to the sector is EV, which is expected to continue maintaining strong growth momentum in production and sales throughout 2023 and 2024.

- However, the leading party remains confident of the domestic and international potential of this sector, especially in light of China’s recent efforts to improve international relationships.

TMT (technology, media, and telecom)

- With the world’s largest internet consumer base, it is unsurprising that China has contributed to many world-leading digital B2C initiatives.

- The TMT industry also had a weak performance in H1 of this year with a decrease in mainland Chinese firms that went public AND a decrease in value of funds which went from RMB133.5 bill (H2 of 2022) to RMB 82.9 bill in H1 of 2023.

- Fortunately, this has slowly improved in H2 of 2023 due to the implementation of rules for filing overseas listings which will make the process of listing overseas more straightforward.

- Then again this will be impacted by the EU due to an update of regulations in their General Data Protection Act, and the US is about to release the American Data Privacy and Protection Act at the start of 2024.

- Interestingly, this setback has not been factored into China’s prediction which is expected to go from US$226 billion to US$305 million by 2028. An increase of 6.1% CAGR – more than twice the US’.

Healthcare

- Early in 2022, the Chinese medical device market reached US142.4 billion – maintaining a 7-year CAGR of 17.5%.

- These investments and innovations slowed down as China returned to normal and the global demand & supply of medical goods slowed. In 2023 this industry sustained slightly stronger levels of growth than others but it stands out because of its rapid growth during the pandemic years.

- A key issue from this growth was corruption and misuse of funds amongst medical officials. Although Chinese officials are currently investigating and tackling this issue, investors are expressing reluctance.

- The government has hesitated in stimulation through policy intervention as this sector has a vast amount of government support in R&D and is expected to jump in demand due to changing demographics and rising incomes.

- Investments are also expected to jump with the next wave of AI and technological innovation. NBS has predicted healthcare to expand at a CAGR of roughly 9.5% between 2023-2027.

Education/Edtech

- Education and Edtech is an industry that may not be high up within global priorities but it is intrinsically linked to China’s future through its role in the one-child policy and population aging, as well as overall unemployment issues.

- Interestingly this market has not been significantly affected by China’s economic performance in 2023. However…

- Pressure on parents in China is vast. Not only are they being encouraged to have children to reverse the legacy of the government’s one-child policy, but Chinese spending on education is the highest in the world with nearly 50% of savings being spent on children’s education.

- In an attempt to control this ‘excessive’ education the Chinese government imposed laws to ban edtech companies from going public and raising capital, making them nonprofits.

- There continues to be an enormous demand for foreign education and qualifications which the Chinese government actively encourages in the face of technological innovation and future upskilling.

- The Edtech market is rapidly growing with projected growth at a CAGR of over 25% between 2021-2026.